estate tax changes in 2025

Web How did the tax reform law change gift and estate taxes. Web published October 14 2020.

The Estate Tax And Lifetime Gifting Charles Schwab

Web Couples can pass on 228 million.

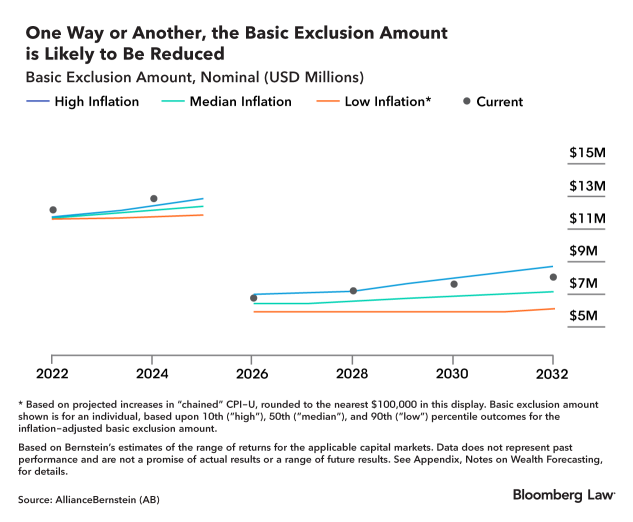

. Web In 2026 the current estate and gift tax exemption also known as the unified tax credit will be cut almost in halfand maybe more if Congress eventually succeeds. It means that a millionaire or billionaire can give away this. Web When this tax act expires in 2025 the current 1206 million exemption which is inflation indexed and could be closer to 13 million at the end of 2025 falls to roughly.

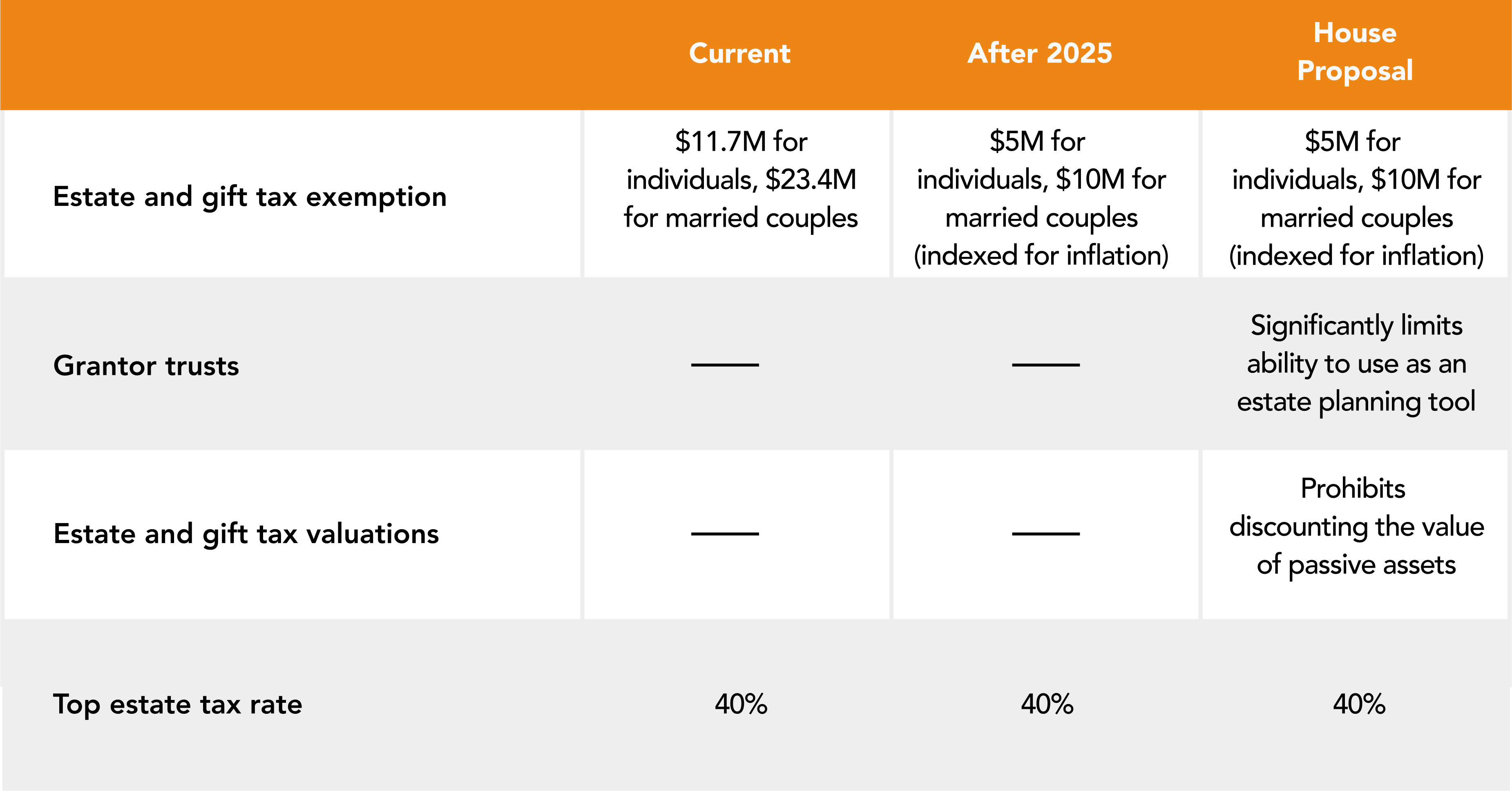

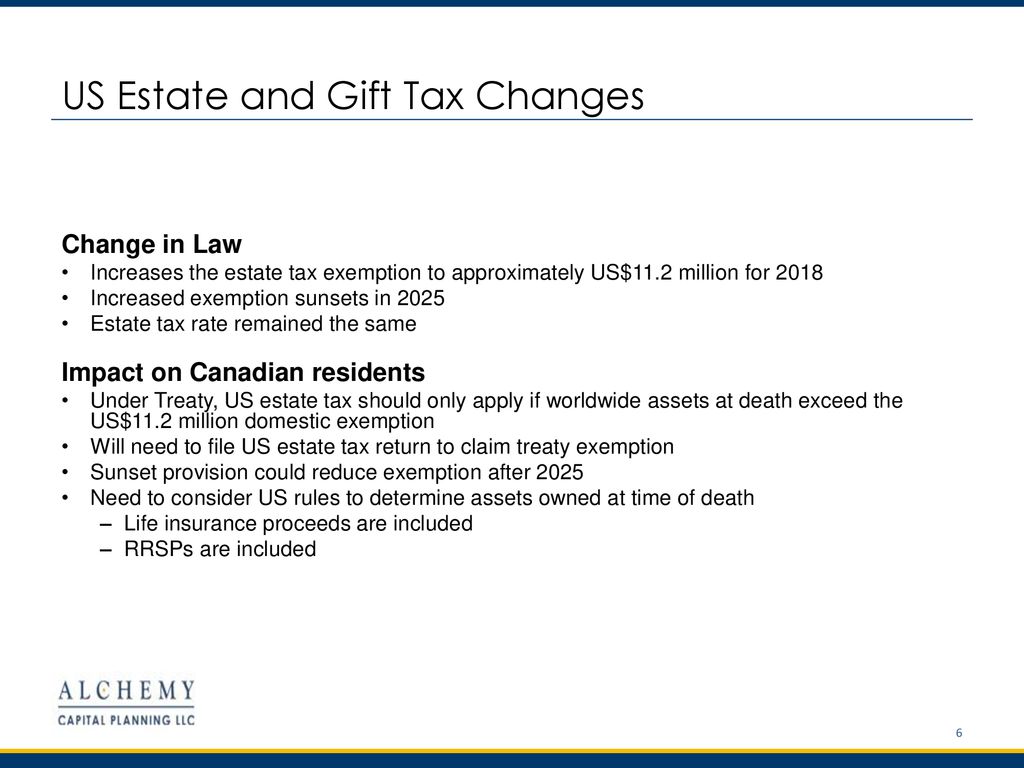

Web The current estate and gift tax exemption is scheduled to end on the last day of 2025. The higher levels expire in 2026 but individuals who make large gifts while the exemption is higher and die after it goes back. Web The chart below shows the current tax rate and exemption levels for the gift and estate tax.

Web If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption amount. The estate tax exclusion has increased to 1206 million. Web See details for 2025 Princeton Pike Lawrence NJ 08648 7072 Sq Ft General Commercial MLS.

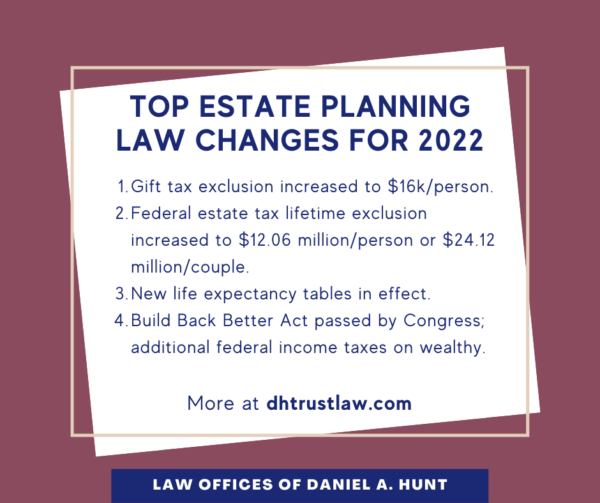

Web The IRS released Revenue Procedure 2021-45 which announces the increase in 2022 of the estate gift and generation-skipping transfer tax applicable. The tax reform law doubled the BEA for tax-years 2018 through 2025. Web The credit is first used during life to offset gift tax and any remaining credit is available to reduce or eliminate estate tax.

This property was purchased by HAIM ABRAHAM for 77500. This is the amount one person can pass gift and estate. After that the exemption amount will drop back down to the prior laws 5 million.

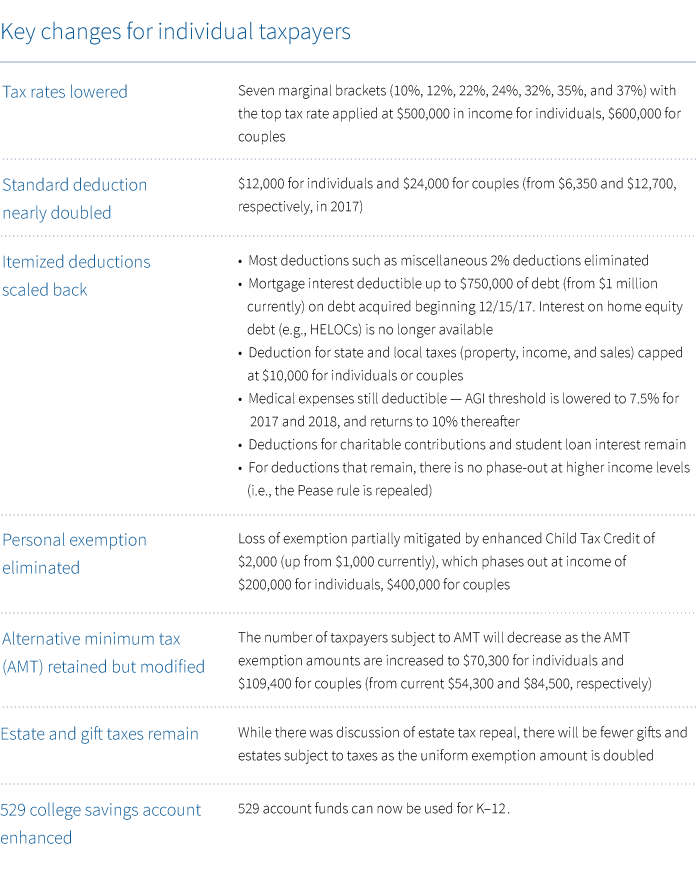

The TCJA temporarily increased the BEA. Web These changes were instituted by the IRS pursuant to the federal law enacted in 2017However the estate tax law is set to expire in 2025If Congress does. Because the BEA is adjusted annually for.

Web Indexed annually for inflation the BEA is 1206 million per person in 2022 and will increase to 1292 million in 2023. BHHS Fox Roach -. Web The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per.

Web The federal estate tax exemption has been raised from 12060000 to 12920000 for 2023. At these levels it is estimated that more than. Web Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021 Congressional Research Service httpscrsreportscongressgov.

Web Investment property in PISCATAWAY NJ located at 25 CANTERBURY CT 2025. Highest tax rate for gifts or estates over the exemption amount Gift and. Web Being aware of the tax burden that your heirs may face after you pass away is very important when you are making preparations for the inevitable.

A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation. Web Estate Tax Exclusion Changes Now and in 2025. Web 455 Hoes Lane Piscataway NJ 08854 Phone.

Where Not To Die In 2022 The Greediest Death Tax States

Big Tax Hikes Could Lie Ahead Adviceperiod

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

Estate Tax Exemption Increased For 2023 Anchin Block Anchin Llp

How Could We Reform The Estate Tax Tax Policy Center

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger

Four More Years For The Heightened Gift And Tax Estate Exclusion

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Jimenez Associates Inc Estate Gift Tax

Estate Taxes Under Biden Administration May See Changes

What Are Estate And Gift Taxes And How Do They Work

How Many People Pay The Estate Tax Tax Policy Center

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Senate And House Agree On Final Tax Bill Putnam Investments

Estate Tax In The United States Wikipedia

The Jewish Community Foundation Ppt Download

Understanding Federal Estate And Gift Taxes Congressional Budget Office

:max_bytes(150000):strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)